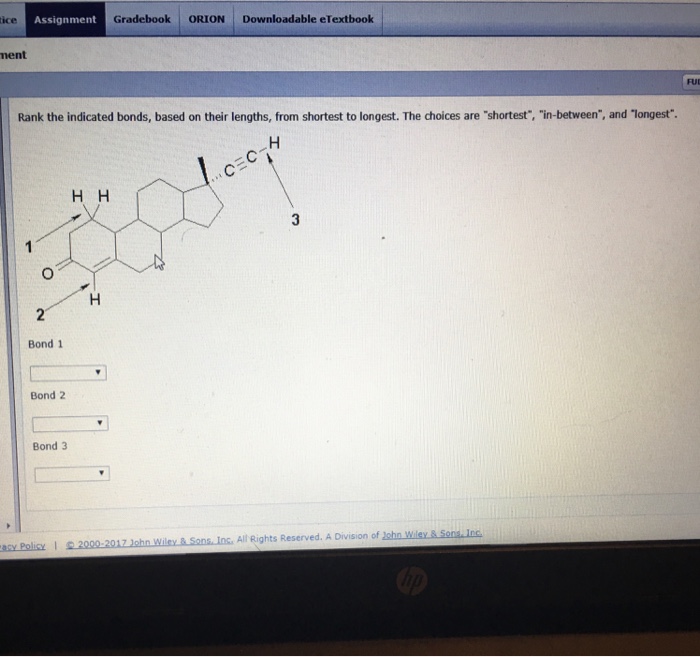

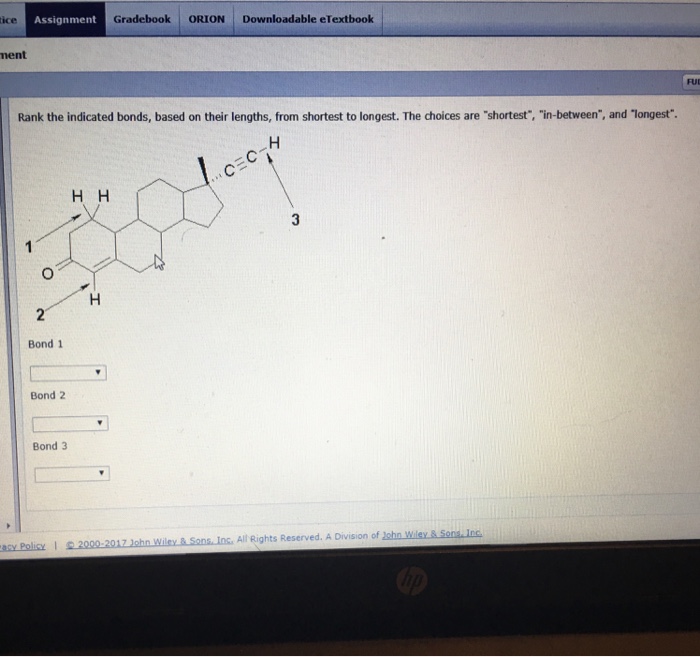

Rank the indicated bonds, based on their lengths, from shortest to longest.

Rank the indicated bonds, based on their lengths, from shortest to longest.

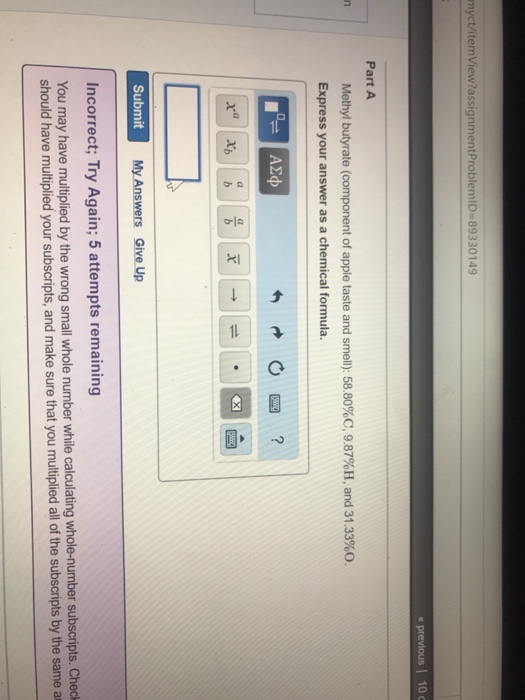

Methyl butyrate (component of apple taste and smell): 58.80% C, 9.87% H, and 31.33% O. Express your answer as a chemical formula.

Please draw the correct structure of 3-ethyl-2,2-dimethylheptane. Keep in mind the drawing below that I drew is incorrect.

Should I purchase the robotic machine?

Capital investment $700,000. Depreciated at $100,000 straightline for 7 years.

Annual maintanence fee $200,000.

Investment can produce 2 products with Margins of $4500 and $5000.

First year will produce 18 X $5000; 30 X $5000, with an annual increase of 2%.

Current volume is 22 units per month.

Robotic surgery is not reimbursed at a higher rate than laparoscopic surgery for inpatient cases. For outpatient cases, commercial payors reimbursing as a percent of charges reimburse more because the charge for robotic surgery is higher. Robotic cases have longer OR case time and shorter lengths of stay. On average, the direct margin on outpatient cases is $2,000 more per case than an equivalent case performed laparoscopically. On average, the direct margin on inpatient cases is $500 less per case than an equivalent case performed laparoscopically.

One provider group would like to use the new equipment to perform complex surgical cases. These cases will be inpatient. They estimate an additional 2-3 cases per month would be performed on the new equipment in year one. These cases would be new to the health system (the surgeons are currently performing the procedures at a competitor’s facility). The average direct margin for these cases performed laparoscopically is $5,000.

The health system is hiring a new surgeon who specializes in outpatient surgery utilizing the robot. They estimate an additional 1-2 cases per month would be performed on the new equipment in year one. These cases would be new to the health system. The average direct margin for these cases performed laparoscopically is $3,000.

Current volume averages 22 cases per month. The average length of each robotic case is 3.5 hours.

The annual growth rate for robotic surgery is 2% per year.

The Robot is located in a room that is scheduled based on Block time. One physician group has the room

blocked on Mondays, Tuesday and Thursdays and a second physician group has the room blocked on

Wednesday and Friday mornings. Currently, Friday afternoons are open for add-on cases from any provider

group. Providers can perform any type of case in the OR during their block time and are not required to use

the robot.

The capital cost of the robot is $700,000 with an additional $200,000 annual maintenance fee (operating

expense. Medical equipment is depreciated using straight-line depreciation over 7 years, the capital

equipment will be expensed at a rate of $100,000 per year to the hospital.

Should the purchase be made?

Answer:

A business’s financial statements show a significant increase in the asset account for deferred expenses. What is the likely impact of this on the business’s borrowing needs?

A) borrowing needs will likely increase during the period

B) borrowing needs will likely decrease during the period

C) borrowing needs will remain the same during the period

Solution

Please solve this problem

Exercise 14-14 (Part Level Submission) The following information is available for Aikman Company 2017 January 1, 2017 $21,100 13,600 27,100 December 31, 2017 $31,000 17,300 21,100 Raw materials inventory Work in process inventory Finished goods inventory Materials purchased Direct labor Manufacturing overhead Sales revenue $151,000 221,000 181,000 901,000 ▼ (a) Your answer is correct. Compute cost of goods manufactured Aikman Company Cost of Goods Manufactured Schedule Inventory, 1/1 13600 Direct Materials Raw Materials Inventory, 1/1 21100

In 20Y1, Rudy’s equipment offered its suppliers 30 day terms, and had accounts receivable days on hand of 30 days and sales of $2.5 million. In 20Y2, Rudy’s changed its terms to 45 days; all of its customers took advantage of the change and paid 15 days later than before. Sales in 20Y2 were $3 million, and accounts receivable at year end were $369,863.

How much did the company’s financing needs increase in 20Y2 as a result of the change in terms?

A) approximately $123,000

B) approximately $141,000

C) approximately $162,000

D) approximately $205,000

Solution:-

Jenna is a single taxpayer with no dependents so she qualifies for one personal exemption. During 2013, she earned wages of $135,000. She doesn’t itemize deductions, so she will take the standard deduction and her personal exemption to calculate 2013 taxable income. In addition, during the year she sold common stock that she had owned for five years for a net profit of $7,500. How much does Jenna owe to the IRS for taxes? Round your intermediated and final answers to the nearest cent.

| 2013 | |||

| Standard Deduction | 6100 |

Copper LLC sells cars and trucks. The unit sales for trucks were 100,000 and the contribution margin was $200,000. For cars the unit sales were 120,000 and the contribution margin was $240,000. If fixed costs are $160,000, how many trucks are needed to breakeven: a. 32,000 b. 34,000 c. 36,000 d. None of the above

Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax table 3.5. Assume that their taxable income this year was $442,000. Round your answers to two decimal places.

As Susan and Stan B