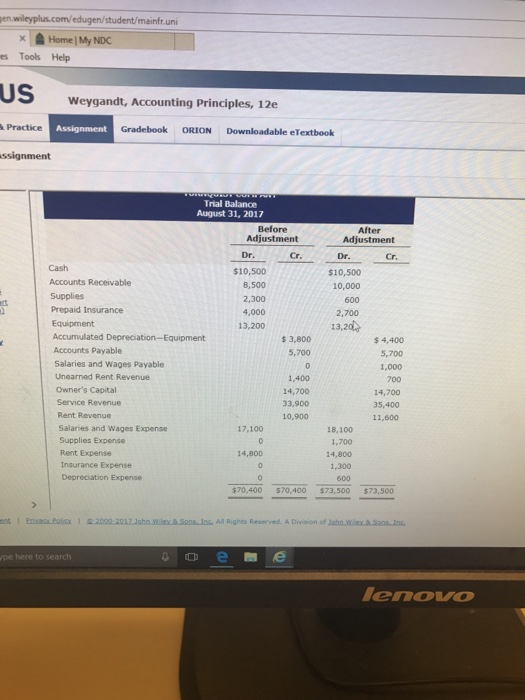

mainfr.uni es Tools Help US Weygandt, Accounting Principles, 12e Practice Gradebook ORION Downloadable eTextbook ssignment Trial Balance August 31, 2017 Before Adjustment After Adjustment Dr Cr Dr. Cr Cash Accounts Receivable $10,500 8,500 2,300 4,000 13,200 $10,500 10,000 600 2,700 Prepaid Insurance Equipment 13,20 Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Unearned Rent Revenue Owner’s Capital Service Revenue Rent Revenue $3,800 5,700 $4,400 5,700 1,000 1,400 14,700 33,900 10,900 700 14,700 35,400 11,600 Salaries and Wages Expense Supplies Expense 17,100 18,100 1,700 14,800 Rent Expense 14,800 Insurance Expense Depreciation Expense 600 $70,400 $70,400 $73,500 $73,500 pe here to search enoVO

Expert Answer

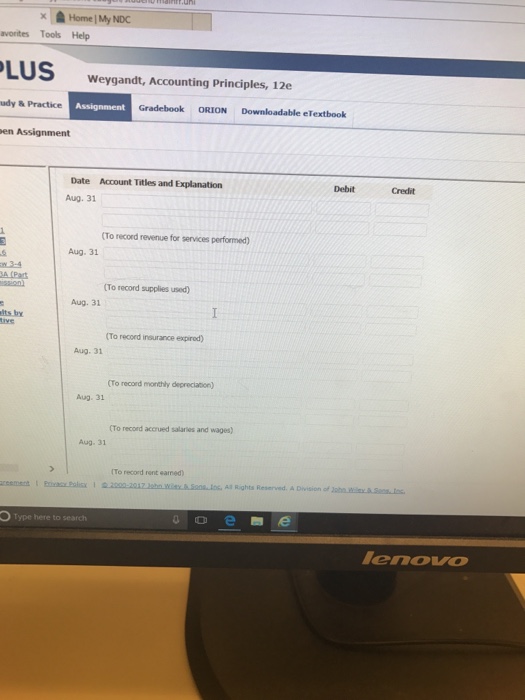

| Date | Accounts Titles & explanation | Debit | Credit |

| Aug.31 | Accounts receivable | 1500 | |

| Service revenue | 1,500 | ||

| (To record revenue for services performed) | |||

| Aug.31 | Supplies expense | 1,700 | |

| Supplies | 1,700 | ||

| (To record supplies used) | |||

| Aug.31 | Insurance expense | 1,300 | |

| Prepiad insurance | 1,300 | ||

| (To record insurance expired) | |||

| Aug.31 | Depreciation expense | 600 | |

| Accumulated depreciation – equipment | 600 | ||

| (To record depreciation expense for the month) | |||

| Aug.31 | Salaries and wages expense | 1,000 | |

| Salaries and wages payable | 1,000 | ||

| (To record accrued salaries and wages) | |||

| Aug.31 | Unearned rent revenue | 700 | |

| Rent revenue | 700 | ||

| (To record rent earned) |