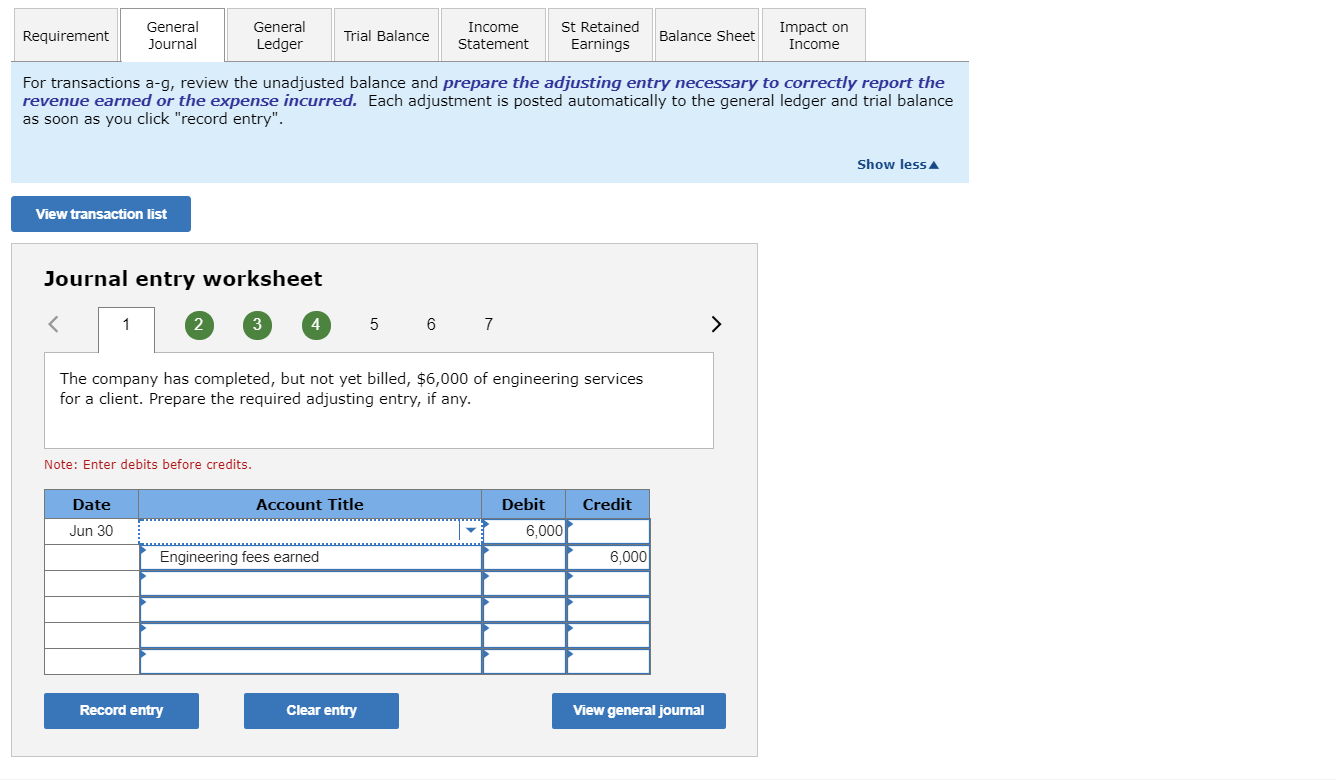

For the journal entry I don’t believe I did it right, can you correct it?

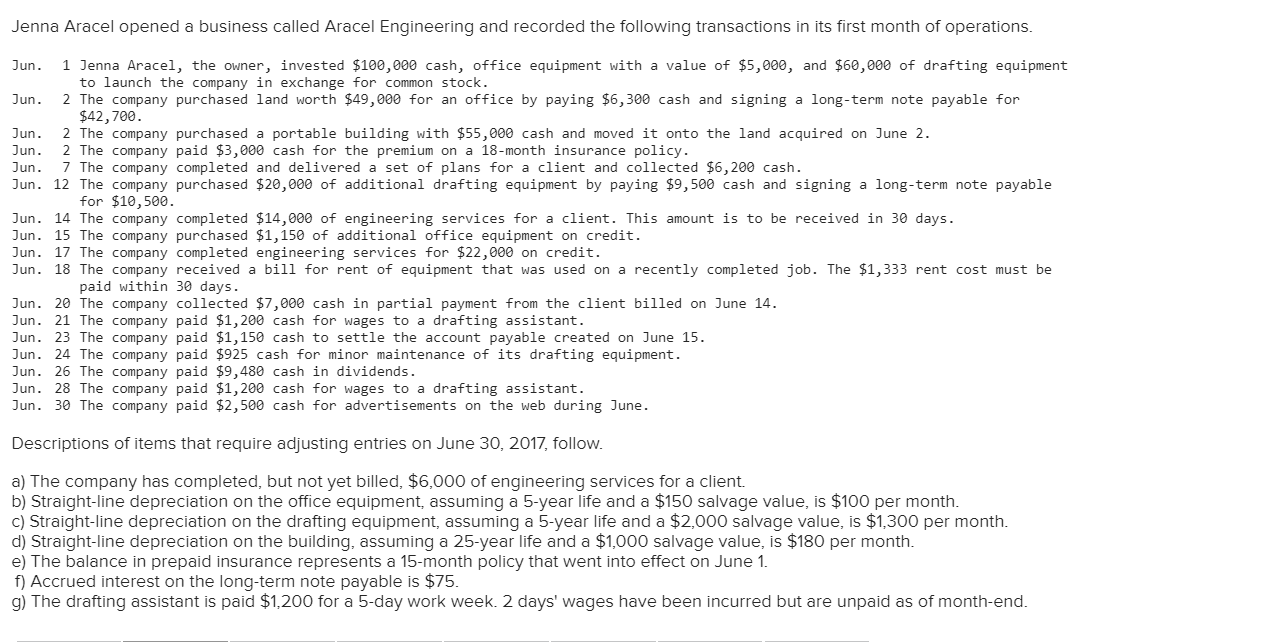

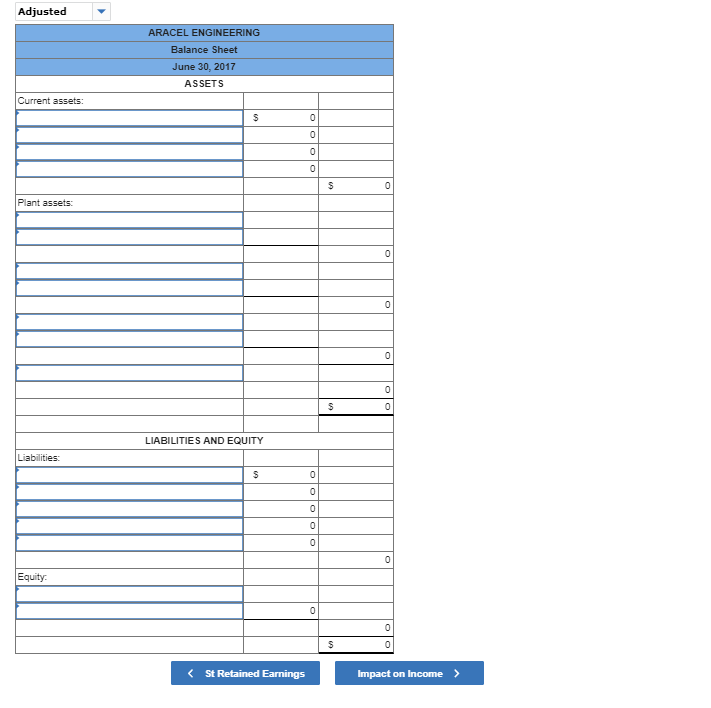

Jenna Aracel opened a business called Aracel Engineering and recorded the following transactions in its first month of operations Jun. 1Jenna Aracel, the owner, invested $100,000 cash, office equipment with a value of $5,000, and $60,000 of drafting equipment Jun. 2 The company purchased land worth $49,000 for an office by paying $6,300 cash and signing a long-term note payable for to launch the company in exchange for common stock. $42,700 Jun. 2 The company purchased a portable building with $55,000 cash and moved it onto the land acquired on June 2. Jun. 2 The company paid $3,000 cash for the premium on a 18-month insurance policy Jun. 7 The company completed and delivered a set of plans for a client and collected $6,200 cash Jun. 12 The company purchased $20,000 of additional drafting equipment by paying $9,500 cash and signing a long-term note payable for $10,500 Jun. 14 The company completed $14,000 of engineering services for a client. This amount is to be received in 30 days Jun. 15 The company purchased $1,150 of additional office equipment on credit. Jun. 17 The company completed engineering services for $22,000 on credit. Jun. 18 The company received a bill for rent of equipment that was used on a recently completed job. The $1,333 rent cost must be paid within 30 days Jun. 20 The company collected $7,000 cash in partial payment from the client billed on June 14 Jun. 21 The company paid $1,200 cash for wages to a drafting assistant Jun. 23 The company paid $1,150 cash to settle the account payable created on June 15 Jun. 24 The company paid $925 cash for minor maintenance of its drafting equipment. Jun. 26 The company paid $9,480 cash in dividends Jun. 28 The company paid $1,200 cash for wages to a drafting assistant. Jun. 30 The company paid $2,500 cash for advertisements on the web during June. Descriptions of items that require adjusting entries on June 30, 2017, follow. a) The company has completed, but not yet billed, $6,000 of engineering services for a client. b) Straight-line depreciation on the office equipment, assuming a 5-year life and a $150 salvage value, is $100 per month c) Straight-line depreciation on the drafting equipment, assuming a 5-year life and a $2,000 salvage value, is $1,300 per month d) Straight-line depreciation on the building, assuming a 25-year life and a $1,000 salvage value, is $180 per month e) The balance in prepaid insurance represents a 15-month policy that went into effect on June 1 f) Accrued interest on the long-term note payable is $75 g) The drafting assistant is paid $1,200 for a 5-day work week. 2 days’ wages have been incurred but are unpaid as of month-end

Expert Answer

| Date | Account title | Debit | Credit |

| Jun 1 | Cash. | 100,000 | |

| Office Equipment | 5,000 | ||

| Drafting Equipment | 60,000 | ||

| Common Stock | 165,000 | ||

| Owner invested cash and equipment. | |||

| Jun 2 | Land | 49,000 | |

| Cash | 6,300 | ||

| Note Payable | 42,700 | ||

| Purchased land with cash and note payable. | |||

| Jun 2 | Building | 55,000 | |

| Cash | 55,000 | ||

| Purchased building. | |||

| Jun 2 | Prepaid Insurance | 3,000 | |

| Cash | 3,000 | ||

| Purchased 15-month insurance policy | |||

| Jun 7 | Cash | 6,200 | |

| Engineering Fees Earned | 6,200 | ||

| Collected cash for completed work | |||

| Jun 12 | Drafting Equipment | 20,000 | |

| Cash | 9,500 | ||

| Note Payable | 10,500 | ||

| Purchased equipment with cash and note payable | |||

| Jun 14 | Accounts Receivable | 14,000 | |

| Engineering Fees Earned | 14,000 | ||

| Completed services for client | |||

| Jun 15 | Office Equipment | 1,150 | |

| Accounts Payable | 1,150 | ||

| Purchased equipment on credit | |||

| Jun 17 | Accounts Receivable | 22,000 | |

| Engineering Fees Earned | 22,000 | ||

| Billed client for completed work | |||

| Jun 18 | Equipment Rental Expense | 1,333 | |

| Accounts Payable | 1,333 | ||

| Incurred equipment rental expense | |||

| Jun20 | Cash | 7,000 | |

| Accounts Receivable | 7,000 | ||

| Collected cash on account | |||

| Jun 21 | Wages Expense | 1,200 | |

| Cash | 1,200 | ||

| Jun23 | Accounts Payable | 1,150 | |

| Cash | 1,150 | ||

| Paid amount due on account | |||

| Jun 24 | Repairs Expense | 925 | |

| Cash | 925 | ||

| Paid for repair of equipment | |||

| Jun 26 | Dividends | 9,480 | |

| Cash | 9,480 | ||

| Paid cash for dividends | |||

| Jun 28 | Wages Expense | 1,200 | |

| Cash | 1,200 | ||

| Jun 30 | Advertising Expense | 2,500 | |

| Cash | 2,500 | ||

| Paid for advertising expense | |||

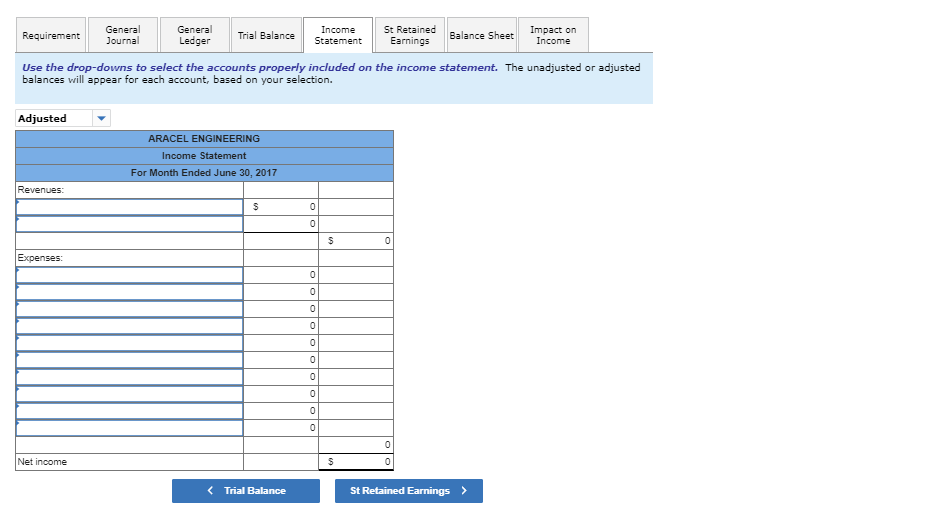

| Adjusting Entries | |||

| Date | Account title | Debit | Credit |

| a. | Accounts Receivable | 6,000 | |

| Engineering Fees Earned | 6,000 | ||

| b. | Depreciation Expense | 100 | |

| Accumulated Depreciation-Office equipment | 100 | ||

| c. | Depreciation Expense | 1,300 | |

| Accumulated Depreciation-Drafting equipment | 1,300 | ||

| d. | Depreciation Expense | 1,300 | |

| Accumulated Depreciation-Building | 1,300 | ||

| e. | Insurance Expense(3000/15) | 200 | |

| Prepaid Insurance | 200 | ||

| f. | Interest expense | 75 | |

| Interest payable | 75 | ||

| g. | Wages expense | 240 | |

| Wages payable | 240 | ||