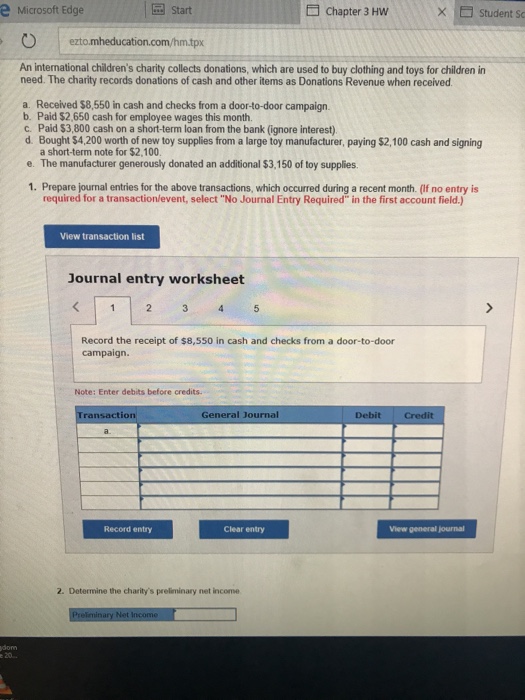

An international children s charity collects donations, which are used to buy clothing and toys for children in need The charity records donations of cash and other items as Donations Revenue when received. a. Received S8.550 in cash and checks from a door-to-door campaign. b. Paid $2, 650 cash for employee wages this month. c. Paid $3, 800 cash on a short-term loan from the bank (ignore interest) d. Bought $4, 200 worth of new toy supplies from a large toy manufacturer, paying $2, 100 cash and signing a short-term note for $2, 100. e. The manufacturer generously donated an additional $3, 150 of toy supplies. Prepare journal entries for the above transactions, which occurred during a recent month (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.) Record the receipt of $8, 550 in cash and checks from a door-to-door campaign. , Determine the charity’s preliminary net income Preliminary Net Income

Expert Answer

Solution;-

1. Cash A/c Dr $8500

To Door to Door Camplaign Sales A/c $8500

(Being Cash received from door to door campaign)

2. Wages A/c Dr $2650

To Cash A/c $2650

(Being Wages paid)

3. Loan from bank A/c Dr $3800

To Cash A/c $3800

(Being Cash paid for Repayment of Short Term Loan)

4. Purchases A/c Dr $4200

To Cash $2100

To Short term Note Payable $2100

(Being Purchases Made)

5. Charity A.c Dr $3150

To Purchases A/c $3150

(Being Charity of Supplies)

Charity Income

Sales = $8550

Less:- Wages = $2650

Less:- Purchases = $1050

Less:- Charity = $3150

Net Income = $1700