Could you please give me all the answer of my question? Thank you.

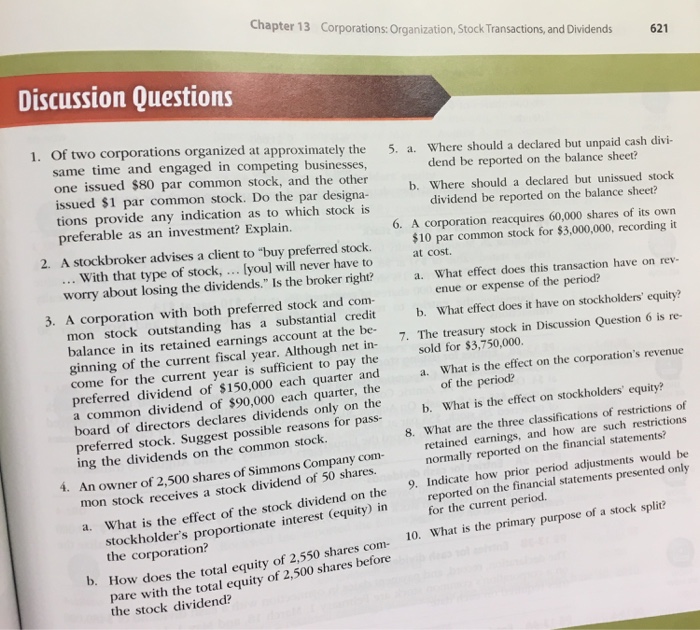

Could you please give me all the answer of my question? Thank you.Chapter 13 Corporations: Organization, Stock Transactions, and Dividends 621 Discussion Questions 1. Of two corporations organized at approximately the same time and engaged in competing businesses one issued $80 par common stock, and the other issued $1 par common stock. Do the par designa tions provide any indication as to which stock is preferable as an investment? Explain 5. a. Where should a declared but unpaid cash divi b. Where should a declared but unissued stock 6. A corporation reacquires 60,000 shares of its own dend be reported on the balance sheet? dividend be reported on the balance sheet? 2. A stockbroker advises a client to “buy preferred stock. 10 par common stock for $3,000,000, recording it With that type of stock,. lyoul will never have to at cost. worry about losing the dividends. ls eoker rightea. What efect does chis transaecton have on rev a. What effect does this transaction have on rev- 3. A corporation with both preferred stock and co enue or expense of the period? b. What effect does it have on stockholders’ equity? mon stock outstanding has a substantial credit balance in its retained earnings account at the be- ginning of the current fiscal year. Although net in come for the current year is sufficient to pay the preferred dividend of $150,000 each quarter anda What is the effect on the corporation’s revenue a common dividend of $90,000 each quarter, the board of directors declares dividends only on the 7· The treasury stock in Discussion Question 6 is re- sold for $3,750,000 of the period? b. What is the effect on stockholders equity? 8. What are the three classifications of restrictions of normally reported on the financial statements? 9. Indicate how prior period adjustments would be preferred stock. Suggest possible reasons for pass ing the dividends on the common stock retained earnings, and how are such restritions An owner of 2,500 shares of Simmons Company com- mon stoc 4. k receives a stock dividend of 50 shares. What is the effect of the stock dividend on the stockholder’s proportionate interest the corporation? orted on the financial statements presented only for the current period. a. (equity) in low does the total equity of 2,550 shares com 10. What is the primary purpose of a stoc pare with the total equity of 2,500 shares before b. How the stock dividend?

Expert Answer

1. From the point of view of an investor, The company with par stock of $1 is preferable because the disinvestment from this stock will be easier in denominations. Partial stock selling will be easier for the investor. Also the liquidity is very high in this stock as compared to the liquidity of the stock with par value of $ 80.

2. No the broker is not completely true. In case the company is running with losses the company may not be able to pay dividends even to its preference shareholders. If the preference shares are cumulative preference shares then the dividends of the preference share holder in such situation will get transferred to another year when the company starts earning profit. In non-cumulative preference shares the shareholders will forego their dividend of such year.

3. A company have obligations towards the payment of preference dividends in case of profits but the legal obligations to pay dividends on common stock does not exists. In case the company earns profit in any year and doesnot pay dividend to its equity shareholders then this can be suggestion that the company is ploughing back its funds and it increasing its reserves. The company may have plans of expansion and in order to not raise money through debt the company opts for its own funds by not paying the dividends for the year.

4. (a) On receipt of 50 shares as stock dividend, the owner has received 2% stock dividend from the company. The company had issued every shareholder such dividends. This will result in an overall increase in the total number of shares of the company by 2%. The increased shares of the owner will not affect the proportionate shareholding of the owner in the company, it will remain the same.

(b) The toal equity of 2550 shares when compared to 2500 shares will result in higher dividend per share. The equity share in the company will remain same but the value of the holding will increase.