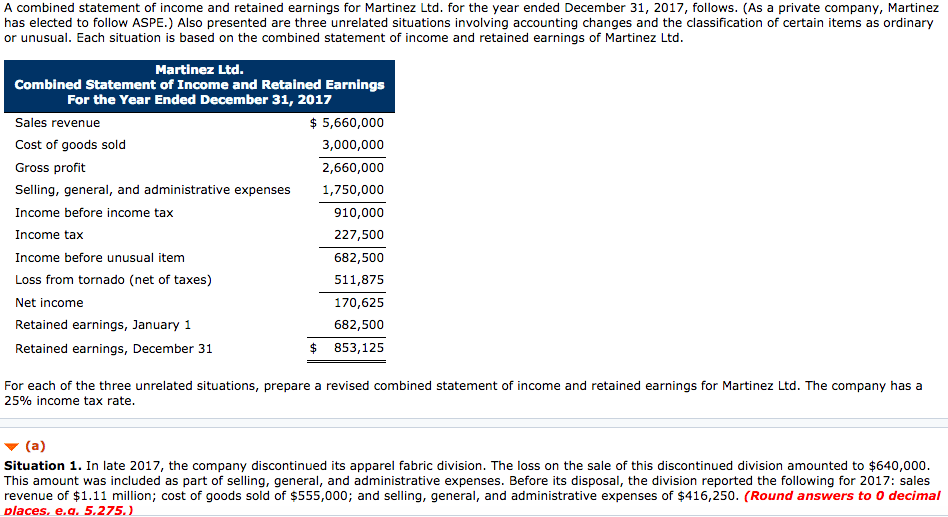

A combined statement of income and retained earnings for Martinez Ltd. for the year ended December 31, 2017, follows. (As a private company, Martinez has elected to follow ASPE.) Also presented are three unrelated situations involving accounting changes and the classification of certain items as ordinary or unusual. Each situation is based on the combined statement of income and retained earnings of Martinez Ltd Martinez Ltd. Combined Statement of Income and Retained Earnings For the Year Ended December 31, 2017 Sales revenue Cost of goods sold Gross profit Selling, general, and administrative expenses Income before income tax Income tax Income before unusual item Loss from tornado (net of taxes) Net income Retained earnings, January 1 Retained earnings, December 31 $5,660,000 3,000,000 2,660,000 1,750,000 910,000 227,500 682,500 511,875 170,625 682,500 $ 853,125 For each of the three unrelated situations, prepare a revised combined statement of income and retained earnings for Martinez Ltd. The company has a 25% income tax rate ▼ (a) Situation 1. In late 2017, the company discontinued its apparel fabric division. The loss on the sale of this discontinued division amounted to $640,000 This amount was included as part of selling, general, and administrative expenses. Before its disposal, the division reported the following for 2017: sales revenue of $1.11 million; cost of goods sold of $555,000; and selling, general, and administrative expenses of $416,250. (Round answers to 0 decimal places, e.a. 5.275.

Expert Answer

| Martinez Ltd. | ||

| Combined Statement of Income and Retained Earnings | ||

| For the Year Ended December 31, 2017 | ||

| Sales revenue ($5660000 – $1110000) | 4550000 | |

| Cost of goods sold ($3000000 – $555000) | 2445000 | |

| Gross profit | 2105000 | |

| Selling, general, and administrative expenses ($1750000 – $640000) | 1110000 | |

| Income from continuing operations before income tax | 995000 | |

| Income tax (25% x $995000) | 248750 | |

| Income before unusual item | 746250 | |

| Loss from tornado (net of taxes) | 511875 | |

| Income from continuing operations | 234375 | |

| Discontinued operations: | ||

| Income (loss) from discontinued operations | -640000 | |

| Income tax benefit (expense) [25% x $640000] | 160000 | |

| Income (loss) from discontinued operations | -480000 | |

| Net income | -245625 | |

| Retained earnings, January 1 | 682500 | |

| Retained earnings, December 31 | 436875 | |