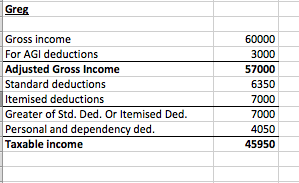

1) Greg is single. During 2017, he received $60,000 of salary from his employer. That was his only source of income. He reported $3,000 of for AGI deductions and $7,000 of itemized deductions. The 2017 standard deduction amount for a single taxpayer is $6,350 and the 2017 exemption amount is $4,050. What is Greg’s taxable income?

Expert Answer