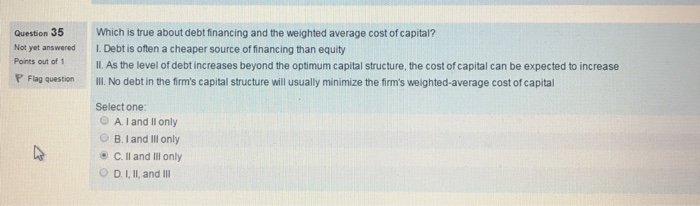

Which is true about debt financing and the weighted average cost of capital? I Debt is often a cheaper source of financing than equity II. As the level of debt increases beyond the optimum capital structure, the cost of capital can be expected to increase III. No debt in the firm’s capital structure will usually minimize the firm’s weighted-average cost of capital Select one: A. I and II only B. I and III only C II and III only D, I, II, and III

Expert Answer

Debt is a cheaper source of financing than equity because in financing through debt the firm gets a tax benefit on the ineterest paid to the lender.Debt has a lower riks than equity as the debt holder have the first claim on company’s asset in case of bankcrupcy but the equity holder lose everything.So as the risk is lower in debt,it is cheaper.Also debt holders have a earning limited to the fixed rate of interest they get every year.When the level of debt increases beyond the optimun capital structure,it would be difficult to pay the interest and principal which results in extra cost and penalties.So,due to thses extra costs,the cost of capital may increase.Debts in the firm’s capital structure minimize the firm’s weighted average cost of capital.