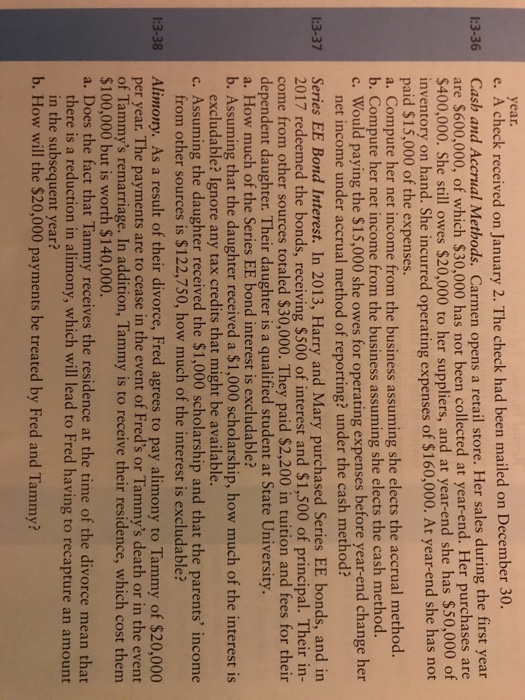

e. A check received on January 2. The check had been mailed on December 30. Cash and Accrual Methods. Carmen opens a retail store. Her sales during the first year are $600,000, of which $30,000 has not been collected at year-end. Her purchases are $400,000. She still owes $20,000 to her suppliers, and at year-end she has $50,000 of inventory on hand. She incurred operating expenses of $160,000. At year-end she has not paid $15,000 of the expenses. a. Compute her net income from the business assuming she elects the accrual method. b. Compute her net income from the business assuming she elects the cash method. c. Would paying the $15,000 she owes for operating expenses before year-end change her net income under accrual method of reporting? under the cash method? Series EE Bond Interest. In 2013, Harry and Mary purchased Series EE bonds, and in 2017 redeemed the bonds, receiving $500 of interest and $1,500 of principal. Their income from other sources totaled $30,000. They paid $2,200 in tuition and fees for their dependent daughter. Their daughter is a qualified student at State University. a. How much of the Series EE bond interest is excludable? b. Assuming that the daughter received a $1,000 scholarship, how much of the interest is excludable? Ignore any tax credits that might be available. c. Assuming the daughter received the $1,000 scholarship and that the parents’ income from other sources is $122,750, how much of the interest is excludable? Alimony. As a result of their divorce, Fred agrees to pay alimony to Tammy of $20,000 per year. The payments are to cease in the event of Fred’s or Tammy’s death or in the event of Tammy’s remarriage. In addition, Tammy is to receive their residence, which cost them $100,000 but is worth $140,000. a. Does the fact that Tammy receives the residence at the time of the divorce mean that there is a reduction in alimony, which will lead to Fred having to recapture an amount in the subsequent year? b. How will the $20,000 payments be treated by Fred and Tammy?

Expert Answer