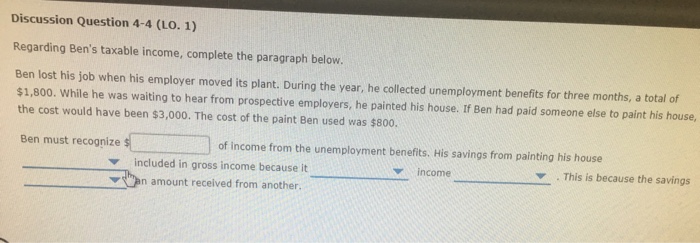

Discussion Question 4-4 (LO. 1) Regarding Ben’s taxable income, complete the paragraph below. Ben lost his job when his employer moved its plant. During the year, he collected unemployment benefits for three months, a total of $1,800. While he was waiting to hear from prospective employers, he painted his house. If Ben had paid someone else to paint his house, the cost would have been $3,000. The cost of the paint Ben used was $800. Ben must recognize of income from the unemployment benefits. His savings from painting his house ▼ . This is because the savings included in gross income because it ▼bn amount received from another. income

Expert Answer

Ben must recognize $1,800 of income from the unemployment benefits. His savings from painting his house are not included in gross income—it was not income realized because the savings were not an amount received from another.