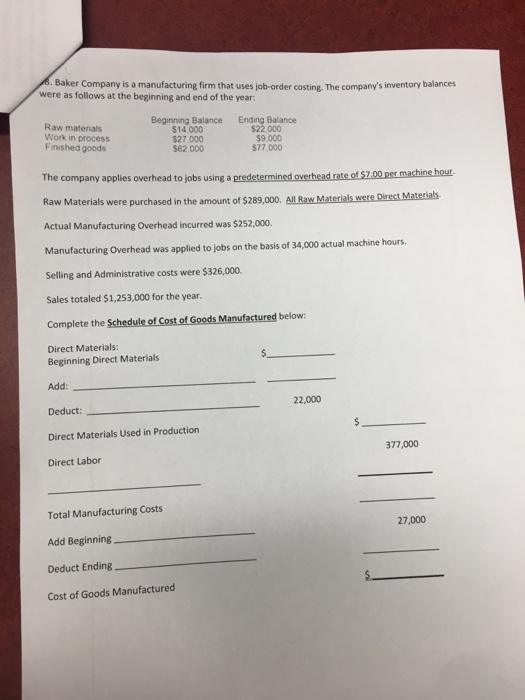

Baker company is a manufacturing form that uses job-order costing. The company’s inventory balances were as follows at the beginning and end of the year: The company applies overhead to jobs using a predetermined overhead rate of $7.00 per machine hour. Raw Materials were purchased in the amount of $289,000. All Raw Materials were Direct Materials. Actual Manufacturing Overhead incurred was $252,000. Manufacturing Overhead was applied to jobs on the basis of 34,000 actual machine hours. Selling and Administrative costs were $326,000. Sales totaled $1,253,000 for the year. Complete the Schedule of Cost of Goods Manufactured below:

Expert Answer

| Statement showing cost of goods Manufactured | |

| Particulars | Amount |

| Beginning inventory, raw materials | 14,000.00 |

| Plus: Purchases of raw materials | 289,000.00 |

| Raw materials available for use = Beg + Purchase | 303,000.00 |

| Less: Ending raw materials inventory | (22,000.00) |

| Cost of direct raw materials used | 281,000.00 |

| Add Direct Labor | 377,000.00 |

| Add Manufacturing overhead | 252,000.00 |

| Total manufacturing costs | 910,000.00 |

| Plus: Beginning work-in-process inventory | 27,000.00 |

| Total work in process | 937,000.00 |

| Less: Ending work-in-process inventory | (9,000.00) |

| Cost of Goods Manufactured | 928,000.00 |