Q20 and Q21 with explanation

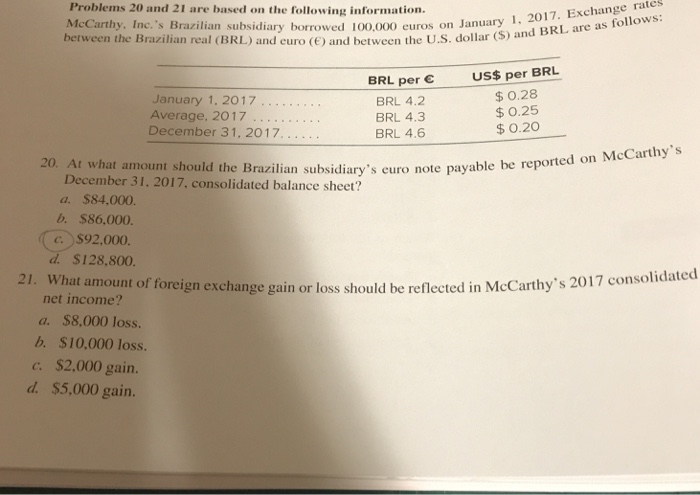

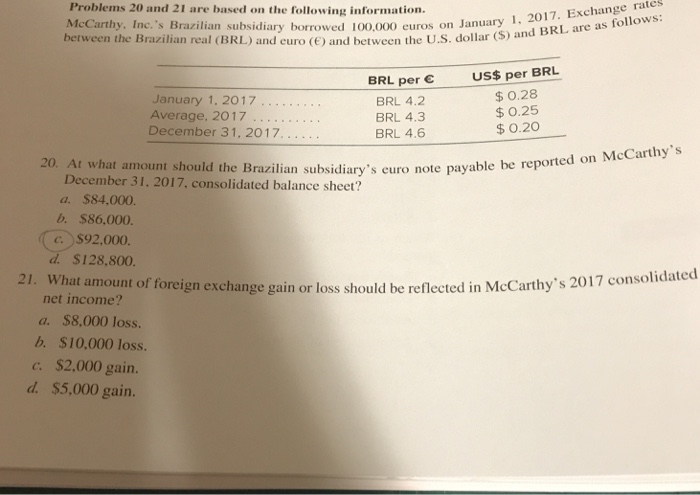

Problems 20 and 21 are based on the following information. McCarthy, Inc.’s Brazilian subsidiary borrowed 100,000 euros on January between the Brazilian real (BRL) and euro (e) and between the U.S. dollar (S) n 1, 2017. Exchange rates and BRL are as follows: US$per BRL BRL per e BRL 4.2 BRL 4.3 BRL 4.6 $ 0.28 $0.25 $0.20 January 1, 2017… December 31, 2017. . . 20. At what amount should the Brazilian subsidiary’s euro note payable be repo December 31. 2017, consolidated balance sheet? a. $84,000. b. $86,000. (c) S92.000. d. $128,800 21. What amount of foreign exchange gain or loss should be reflected in McCarthy’s 2017cnsoi net income? a. $8,000 loss. b. $10,000 loss. c. $2.000 gain. d. $5,000 gain.

Expert Answer

| Q-20 | BRL PER EURO | US $ PER BRL | CONVERSION | |

| ANS;- C | 4.6 | 0.2 | BRL PER EURO X US $ PER BRL X 100000 | =92000 |