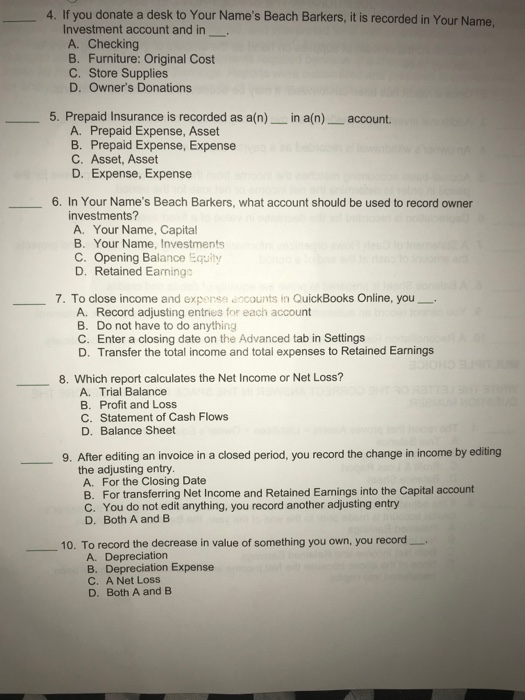

4. If you donate a desk to Your Name’s Beach Barkers, it is recorded in Your Name, Investment account and in A. Checking B. Furniture: Original Cost C. Store Supplies D. Owner’s Donations 5. Prepaid Insurance is recorded as a(n) in a(n)account. A. Prepaid Expense, Asset B. Prepaid Expense, Expense C. Asset, Asset D. Expense, Expense 6. In Your Name’s Beach Barkers, what account should be used to record owner investments? A. Your Name, Capital B. Your Name, Investments C. Opening Balance Equity D. Retained Earningo 7. To close income and expense accounts in QuickBooks Online, you_ A. Record adjusting entries for each account B. Do not have to do anything C. Enter a closing date on the Advanced tab in Settings D. Transfer the total income and total expenses to Retained Earnings 8. Which report calculates the Net Income or Net Loss? A. Trial Balance B. Profit and Loss C. Statement of Cash Flows D. Balance Sheet 9. After editing an invoice in a closed period, you record the change in income by editing the adjusting entry A. For the Closing Date B. For transferring Net Income and Retained Earnings into the Capital account C. You do not edit anything, you record another adjusting entry D. Both A and B 10. To record the decrease in value of something you own, you record. A. Depreciation B. Depreciation Expense C. A Net Loss D. Both A and B

Expert Answer

Answer 4 ) Option B

Answer 5 ) Option A

Answer 6 ) Option A

Answer 7 ) Option C ( one has to only enter a date and the software will automatically close all the revenue and expense accounts and transfer the profit / loss to retained earnings )

Answer 8 ) Option B

Answer 9 ) Option A

Answer 10 ) Option B