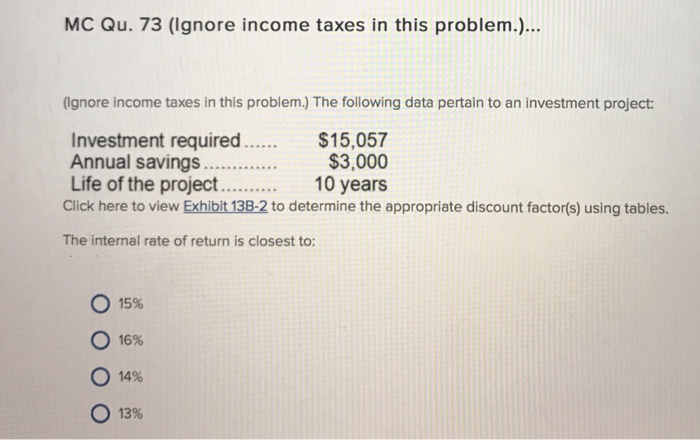

The following data pertain to an investment project: Investment required……$15,057 Annual savings…..$3,000 Life of the project…… 10 years Click here to view Exhibit 138-2 to determine the appropriate discount factor(s) using tables. The internal rate of return is closest to: 15% 16% 14% 13%

Expert Answer

The correct answer is 15%

Note :

Let the IRR be x

The Present Value of Cash Outflows=Present Value of Cash Inflows

15,057= 3,000/(1.0x) +3,000/ (1.0x)^2 + 3,000/(1.0x)^3 +3,000/(1.0x)^4+ 3,000/(1.0x)^5+ 3,000/(1.0x)^6+ 3,000/(1.0x)^7+ 3,000/(1.0x)^8+ + 3,000/(1.0x)^9+ + 3,000/(1.0x)^10

15,057 / 3,000 = 1/(1.0x) + 1/(1.0x)^2 + 1/(1.0x)^3+ 1/(1.0x)^4 + 1/(1.0x)^5+ 1/(1.0x)^6+ 1/(1.0x)^7 + 1/(1.0x)^8 + 1/(1.0x)^9 + 1/(1.0x)^10

Hence, 5.019= 1/(1.0x) + 1/(1.0x)^2 + 1/(1.0x)^3+ 1/(1.0x)^4 + 1/(1.0x)^5+ 1/(1.0x)^6+ 1/(1.0x)^7 + 1/(1.0x)^8 + 1/(1.0x)^9 + 1/(1.0x)^10

Looking at annuity factor for 15% and using the same in the above equation ,we get the IRR to be 15%