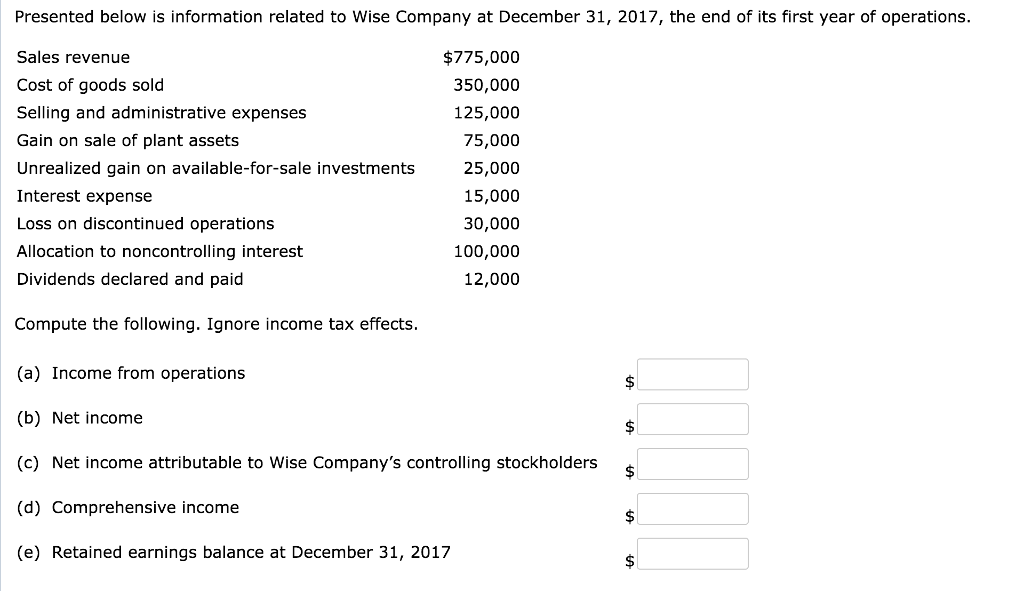

Presented below is information related to Wise Company at December 31, 2017, the end of its first year of operations Sales revenue Cost of goods sold Selling and administrative expenses Gain on sale of plant assets Unrealized gain on available-for-sale investments Interest expense Loss on discontinued operations Allocation to noncontrolling interest Dividends declared and paid $775,000 350,000 125,000 75,000 25,000 15,000 30,000 100,000 12,000 Compute the following. Ignore income tax effects (a) Income from operations (b) Net income (c) Net income attributable to Wise Company’s controlling stockholders s (d) Comprehensive income (e) Retained earnings balance at December 31, 2017

Expert Answer

(a)

| Sales revenue | $775,000 |

| Cost of goods sold | $350,000 |

| Gross profit | $425,000 |

| Selling administrative expenses | $125,000 |

| Income from operations | $300,000 |

(b)

| Income from operations | $300,000 |

| Other revenues and gains | |

| Gain on sale of plant assets | $75,000 |

| Other expenses and losses | $375,000 |

| Interest expense | $15,000 |

| Income from continuing operations | $360,000 |

| Loss on discontinued operations | $30,000 |

| Net Income | $330,000 |

(c)

| Net Income | $330,000 |

| Allocation to noncontrolling interest | $100,000 |

| Net income attributable to controlling shareholders | $230,000 |

(d)

| Net income | $330,000 |

| Unrealized gain on available-for-sale investments | $25,000 |

| Comprehensive income | $355,00 |