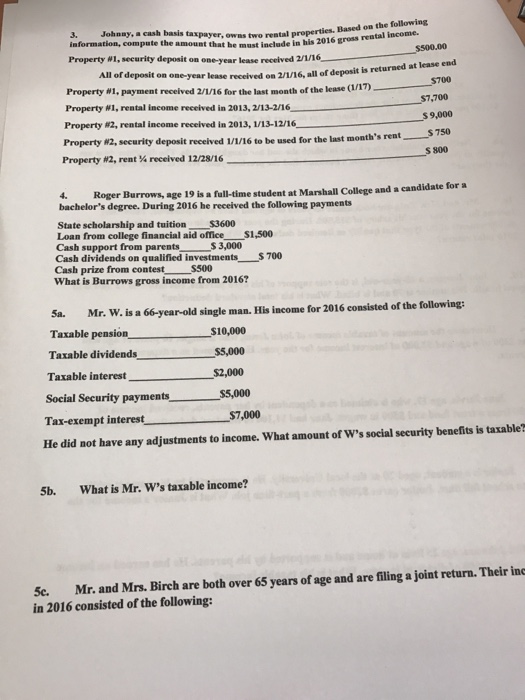

owias two rental properties. Based on the following must inelude in his 2016 gross rental income. 3. Johnny, a cash basis taxpayer, rental prope Property WI, security deposit on one-year lease recelved 2/1/16 $500.00 All of deposit on one-year lease received on 2/1/16, all of deposit is 1/17) returned at lease end Property W1, payment recelved 2/1/16 for the last month of the lease C Property #1, rental income received in 2013, 2/13-2/16 Property #2, rental income recelved in 2013, 1/13-12/16 $700 $7,700 $ 9,000 deposit received 1/1/16 to be used for the last month’s rent5750 S 800 Property #2, rent received 12/28/16 4 Roger Burrows, age 19 is a full-time student at Marshall College and a candidate for a bachelor’s degree. During 2016 he received the following payments State scholarship and tuition $3600 Loan from college financial aid office $1,500 Cash support from parents Cash dividends on qualified investments $700 Cash prize from contest $500 What is Burrows gross income from 2016? $ 3,000 5a. Mr. W. is a 66-year-old single man. Hlis income for 2016 consisted of the following: Taxable pension Taxable dividends$5,000 Taxable interest$2,000 Social Security payments Tax-exempt interest$7,000 He did not have any adjustments to income. What amount of W’s social security benefits is taxable? $10,000 S5,000 5b. What is Mr. W’s taxable income? 5c. Mr. and Mrs. Birch are both over 65 years of age and are filing a joint return. Their in in 2016 consisted of the following:

Expert Answer

Answering the first question as question number has not been mentioned

some rules for rental income taxation

Advance rent is any amount you receive before the period that it covers. Include advance rent in your rental income in the year you receive it regardless of the period covered or the method of accounting you use.

For example, you sign a 10-year lease to rent your property. In the first year, you receive $5,000 for the first year’s rent and $5,000 as rent for the last year of the lease. You must include $10,000 in your income in the first year.

Security deposits used as a final payment of rent are considered advance rent. Include it in your income when you receive it. Do not include a security deposit in your income when you receive it if you plan to return it to your tenant at the end of the lease. But if you keep part or all of the security deposit during any year because your tenant does not live up to the terms of the lease, include the amount you keep in your income in that year.

rental income to be included in 2016 gross rental income.

Property 1:

* security deposit : $500 would be excluded as have to return

* Payment recieved for the last month rent $700 would be considered

* Rental income received in 2013 would be considered in 2013 period only so exclude this, $7700 excluded

Property 2

* Rental income received in 2013 would be considered in 2013 period only so exclude this, $9000 excluded

* security deposit for last month would be included : $750

*Rent 1/4 received that i $800 would be included as it is in the same financial year

Total gross income from both the properties : $2250