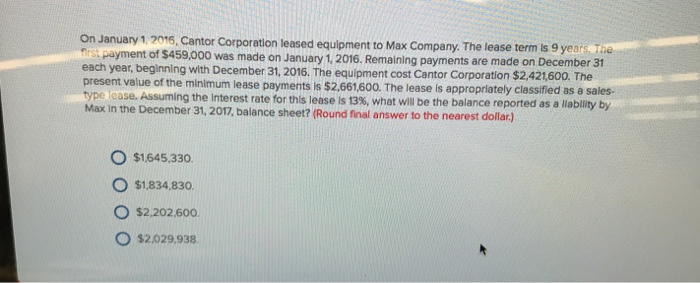

On January 1.2016, Cantor Corporation leased equipment to Max Company. The lease term s 9 years a first payment of $459,000 was made on January 1. 2016. Remaining payments are made on December 31 each year, beginning with December 31, 2016. The equipment cost Cantor Corporation $2,421,600. The present value of the minimum lease payments is $2.661.600. The lease is appropriately classified as a sales- p se. Assuming the Interest rate for this lease is 13%, what will be the balance reported as a liablity by Max in the December 31, 2017, balance sheet? (Round final answer to the nearest dollar) O $1645.330. O $1.834,830 O $2.202,600 O $2.029,938

Expert Answer

| JOURNAL ENTRY AT THE INCEPTION OF LEASE | ||||||

| Leased asset | $2,661,600 | |||||

| Lease Liability | $2,661,600 | |||||

| JOURNAL ENTRY FOR FIRST PAYMENT ON JANUARY 1,2016 | ||||||

| Lease liability | $459,000 | |||||

| Cash | $459,000 | |||||

| JOURNAL ENTRY FOR FIRST PAYMENT ON DECEMBER 31,2016 | ||||||

| Lease Liability(459000-286338) | $ 172,662 | |||||

| Interest expense(13% of (2661600-459000) | $ 286,338 | |||||

| Cash | $459,000 | |||||

| LEASE LIABILITY ACCOUNT | ||||||

| At inception of lease | $2,661,600 | |||||

| .Jan1,2016 | First lease payment | $459,000 | ||||

| .Dec. 31,2016 | Second lease payment | $172,662 | ||||

| Ending balance of liability | $ 2,029,938 | (2661600-459000-172662) | ||||

| Total | $2,661,600 | $2,661,600 | ||||

| Balance Reported as Liability by Max at year end=$2029938 | ||||||

| ANSWER;$2029938 | ||||||