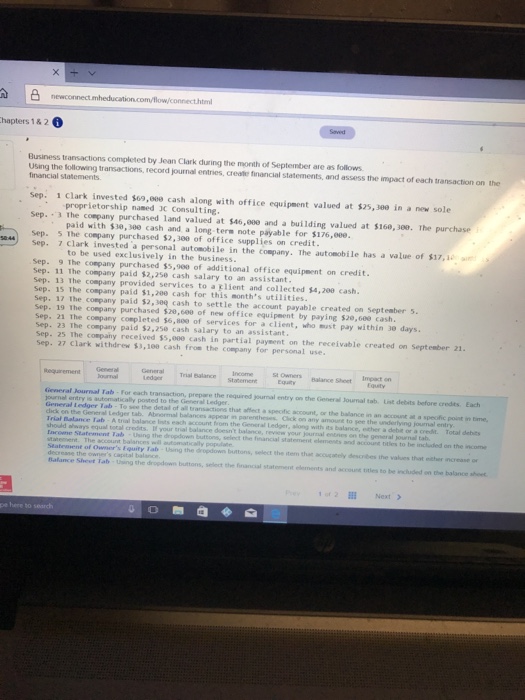

n.com/flow/connect.html hapters 1& 2 Business transactions completed by Jean Clark during the month of September are as follows Using the ollowing transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements sep: 1 Clark invested s69,000 cash along with office equipment valued at $25, 30 in a new sole proprietorship named 3C Consulting. paid with $38, 300 cash and a long-term note payable for s176,0. to be used exclusively in the business Sep.门the conpany purchased land valued at $46,000 and building valued at $160,100. The purch Sep. 5 The company purchased $2,300 of office supplies on credit Sep. 7 Clark invested a personal automobile in the compamy. The automobile has a value of $17,1 Sep. 9 The conpany purchased $5,900 of additional office equipeent on credit. Sep. 11 The company paid $2,250 cash salary to an assistant Sep. 13 The coepany provided services to a ylient and collected 4,200 cash. Sep. 15 The company paid $1,20e cash for this month’s utilities sep. 17The company paid $2,eq cash to settle the account payable created on Septeebr . sep. 19 The coepany purchased $20,600 of new office equipeent by paying $2,668 cash Sep. 21 The company completed $6,800 of services for a client, who must pay within 30 days. sep. 23 The company paid $2,250 cash salary to an assistant Sep. 25 The compahy received 55,000 cash in partial payment on the receivable created on September 21. Sep. 27 Clark withdrew $1,100 cash from the c any for personal use lournlGeneral hournal fabh For each transaction, prepare the requred yournal entry on the Geineral Journal tab. List debits before credts. Each affect a specific account, or the balance in an account at a speofic point i General Ledger Tab-To see the detal of all transactions that shold ahways equal total credits. If your trial balance doesn’t balance, review your journal entries on the general journal tab Staten,ent of Owner’s ‘qu·ity ,ab Using the dropdown buttons, select the item that accurately odes ihe values that other ncreas the Geeral Ledger tab、 Atromnal balances rat. A trial talante “nts-ach·count torn the General Ledger, aking with its balance, ether a debt or a credit. Total delts the financial statement elements and account titles to be included on the income decrease the owners Bafance Sheet Tab-Using the drodown buttons, select the financial statoment elements and account titles to be ncluded on the balance shee pe here to

Expert Answer

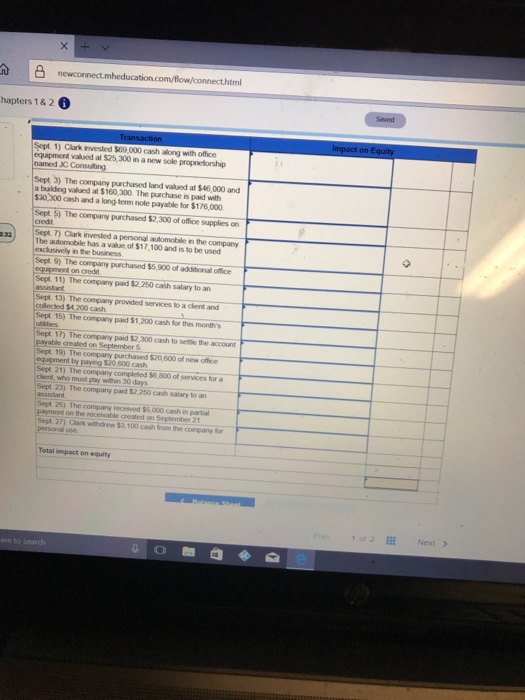

| Transaction | Impact on Equity | Increases | Decreases | |

| Sept 1. Clark invested $69,000 cash along with office equipment valued at $25,300 in a new sole proprietorship named JC Consulting | Cash is an asset account. Addition of cash increases asset account and owner’s equity by $69,000. Office equipment is also an asset account, so addition of equipment increases owner’s equity by $25,300. | $94,300 | ||

| Sept 3. Purchase of land $46,000 and building $160,300. Cash payment $30,300 and long-term notes payable $176,000. | Purchase of land and building has no impact on owner’s equity. Cash payment decreases current assets by $30,300 and incresaes fixed assets $206,300, while issue of long-term note payable for the purchase of fixed asset, increases fixed asset and creates a long-term liability for $176,000. | no effect | no effect | |

| Sept 5. Purchase of office supplies $2,300 on credit | This transaction increases asset account (Supplies) by $2,300 and creates a current liability – Accounts Payable $2,300. So no impact on owner’s equity. | no effect | no effect | |

| Sept 7. Addition of personal automobile for exclusive use of business | Addition of personal automobile increases fixed assets account by $17,100 and increases owener’s equity by $17,100. | $17,100 | ||

| Sept 9. Purchase of additional office equipment on credit | Increases fixed assets (total assets) by $5,900 and creates a liability for $5,900, no impact on owener’s equity. | no effect | no effect | |

| Sept 11. Cash salary to an assistant | salary paid to an assistant is an expense, the transaction decreases owner’s equity by $2,250 | $2,250 | ||

| Sept 13. Provides services and collects revenue | Revenues collected for services rendered increases equity by $4,200 and increases the asset account – cash by $4,200 | $4,200 | ||

| Sept 15. Utilities paid in cash | Utiliites paid in cash is an expense, the transaction decreases owner’s equity and cash by $1,200 | $1,200 | ||

| Sept 17. Cash paid to settle accounts payable | The transaction reducec asset account – cash by $2,300 and the liability account – accounts payable by $2,300. No impact on owner’s equity. | no effect | no effect | |

| Sept 19. Purchase of office equipment for cash | Purchase of office equipment for cash increases equipment account by $20,000 and decreases cash by $20,000. No impact on owner’s equity. | no effect | no effect | |

| Sept 21. Services rendered and to be paid in 30 days | The transaction increases asset account – accounts receivable by $6,800 and increases owner’s equity by $6,800. | $6,800 | ||

| Sept 23. cash salary paid to an assistant | The transaction is an expense, hence reduces owner’s equity by $2,250 as well as cash is reduced by $2,250. | $2,250 | ||

| Sept 25. Cash received for partial payment of receivables | The transaction has no impact owner’s equity. Accounts Receivable is reduced by $5,000 and cash is increased by $5,000. | no effect | no effect | |

| Sept 27. cash withdrawal | The withdrawal transaction reduces owner’s equity by $3,100 and cash is reduced by $3,100. | $3,100 | ||

| $122,400 | $8,800 | |||

| Net impact on owner’s equity | Increaes equity | $113,600 | ||