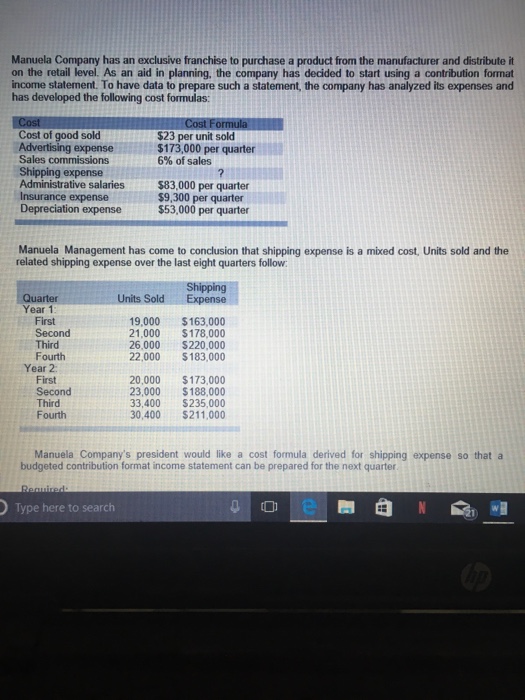

Manuela Company has an exclusive franchise to purchase a product from the manufacturer and distribute it on the retail level. As an aid in planning, the company has decided to start using a contribution format income statement. To have data to prepare such a statement, the company has analyzed its expenses and has developed the following cost formulas: Cost of good sold Advertising expense Sales commissions Shipping expense Administrative salaries$83,000 per quarter Insurance expense Depreciation expense $23 per unit sold $173,000 per quarter 6% of sales $9,300 per quarter $53,000 per quarter Manuela Management has come to conclusion that shipping expense is a mixed cost, Units sold and the related shipping expense over the last eight quarters follow Shipping Units SoldExpense Year 1 First Second Third Fourth 19,000 $163,000 21,000 $178,000 26,000 S220,000 22,000$183,000 Year 2 First Second Third Fourth 20,000 $173,000 23,000 $188,000 33,400 $235,000 30,400$211,000 Manuela Company’s president would like a cost formula derived for shipping expense so that a budgeted contribution format income statement can be prepared for the next quarter Type here to search 0

Expert Answer

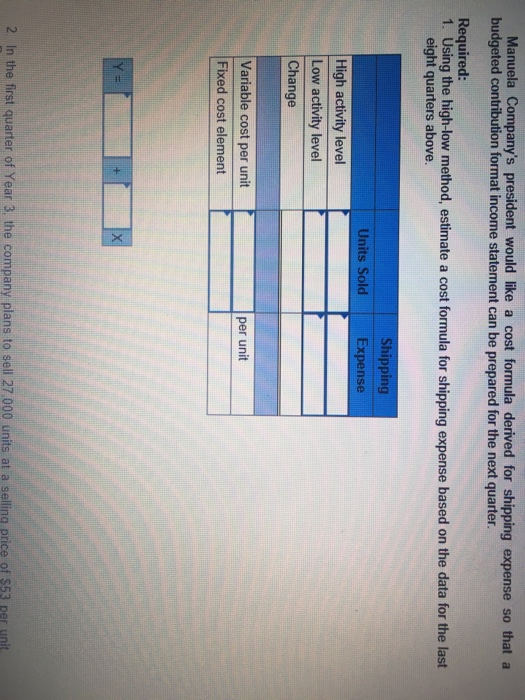

| Units sold | Shipping expense | |||

| High activity level | 33400 | 235000 | ||

| Low activity level | 19000 | 163000 | ||

| Change | 14400 | 72000 | ||

| Variable costs per unit | 5 | |||

| Fixed cost element | 68000 | |||

| 2 | ||||

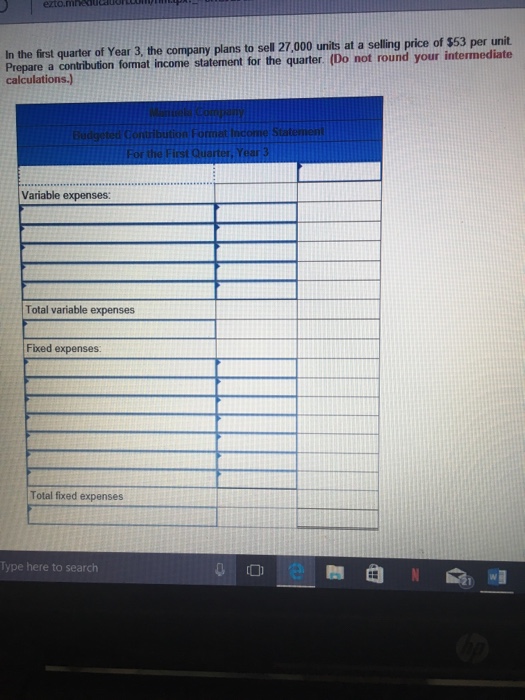

| Budgeted Contribution format income statement | ||||

| Sales revenue | 1431000 | |||

| Variable expenses: | ||||

| Cost of goods sold | 621000 | |||

| Sales commissions | 85860 | |||

| Shipping expense | 135000 | |||

| Total Variable expenses | 841860 | |||

| Contribution margin | 589140 | |||

| Fixed expenses: | ||||

| Advertising expense | 173000 | |||

| Administrative salaries | 83000 | |||

| Insurance expense | 9300 | |||

| Depreciation expense | 53000 | |||

| Shipping expense | 68000 | |||

| Total Fixed expenses | 386300 | |||

| Net operating income | 202840 | |||