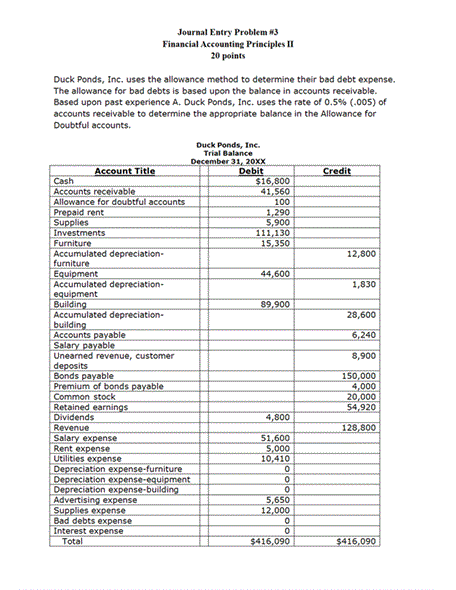

Journal Entry Problem #3 Financial Accounting Principles II 20 points Duck Ponds, Inc, uses the allowance method to determine their bad debt expense. The allowance for bad debts is based upon the balance in accounts receivable. Based upon past experience A. Duck Ponds, Inc. uses the rate of 0.5% (.005) of accounts receivable to determine the appropriate balance in the Allowance for Doubtful accounts. Duck Ponds, Inc. Trial Balance 3420xx 41,S60 100 290 5.900 111,130 Accounts receivable Allowance for doubtful accounts Furniture Accumulated depreciation- 12,800 44,600 Equipment Accumulated depreciation- 1,830 Building Accumulated depreciation- 28,600 Accounts Salary payable Unearned revenue, customer Bonds payable Premium of bonds Common stock Retained 8,900 150,000 ,000 20,000 51.600 S,000 10.410 Rent expense Utilities expense Depreciation e Depreciation e Depreciation expense-b Advertising expense Supplies expense Bad debts expense Interest ex 416 416

Expert Answer

Allowance for Doubtful Accounts:

| $ | $ | ||

| Beginning balance | 100 | Bad Debt Expense | 307.80 |

| Ending balance ( $ 41,560 x 0.5%) | 207.80 | ||

| 307.80 | 307.80 |

Adjusting entry :

| Date | Account Titles | Debit | Credit |

| $ | $ | ||

| December 31, 20XX | Bad Debt Expense | 307.80 | |

| Allowance for Doubtful Accounts | 307.80 |