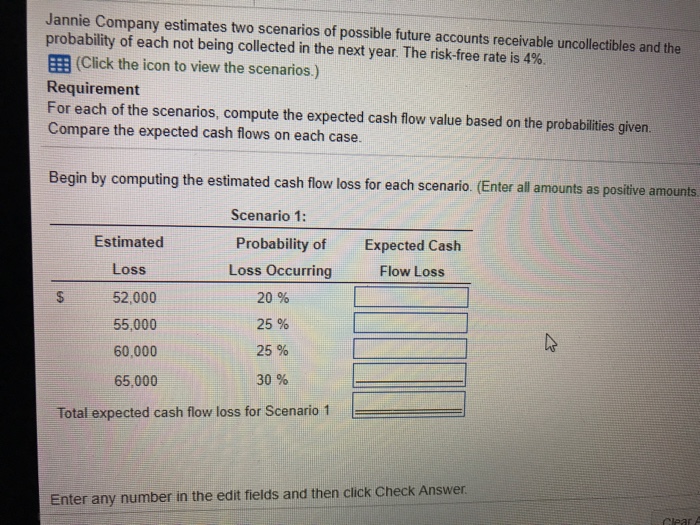

Jannie Company estimates two scenarios of possible future accounts receivable uncollectibles and the probability of each not being collected in the next year. The risk-free rate is 4%. 囲(Click the icon to view, the scenarios.) Requirement For each of the scenarios, compute the expected cash flow value based on the probabilities given. Compare the expected cash flows on each case gin by computing the estimated cash flow loss for each scenario. (Enter all amounts as positive amounts Scenario 1: Probability of Loss Occurring Estimated Expected Cash Loss 52,000 55,000 60,000 65,000 Flow Loss S 20 % 25 % 25 % 30 % Total expected cash flow loss for Scenario 1 Enter any number in the edit fields and then click Check Answer

Expert Answer

Expected cash flow loss=Estimated loss*Probability of Loss occurring

| Estimated Loss | Probability of Loss Ocurring | Expected Cash Flow Loss |

| 52000 | 20% | (52000*20%)=$10400 |

| 55000 | 25% | $13750 |

| 60,000 | 25% | $15000 |

| 65000 | 30% | $19500 |

| Total expected cash flow loss | $58650. |