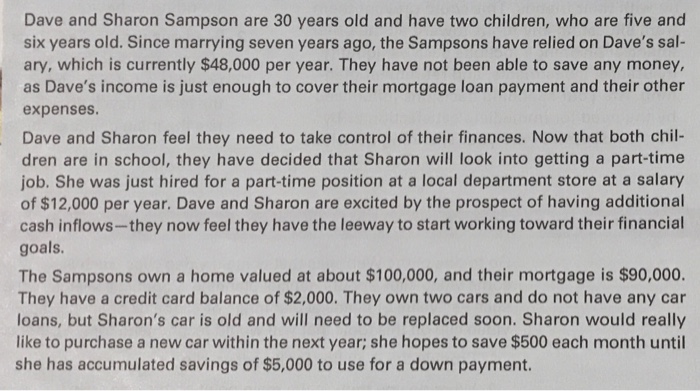

Dave and Sharon Sampson are 30 years old and have two children, who are five and six years old. Since marrying seven years ago, the Sampsons have relied on Dave’s sal- ary, which is currently $48,000 per year. They have not been able to save any money, as Dave’s income is just enough to cover their mortgage loan payment and their other expenses Dave and Sharon feel they need to take control of their finances. Now that both chil- dren are in school, they have decided that Sharon will look into getting a part-time job. She was just hired for a part-time position at a local department store at a salary of $12,000 per year. Dave and Sharon are excited by the prospect of having additional cash inflows-they now feel they have the leeway to start working toward their financial goals The Sampsons own a home valued at about $100,000, and their mortgage is $90,000. They have a credit card balance of $2,000. They own two cars and do not have any car loans, but Sharon’s car is old and will need to be replaced soon. Sharon would really like to purchase a new car within the next year; she hopes to save $500 each month until she has accumulated savings of $5,000 to use for a down payment.

Expert Answer

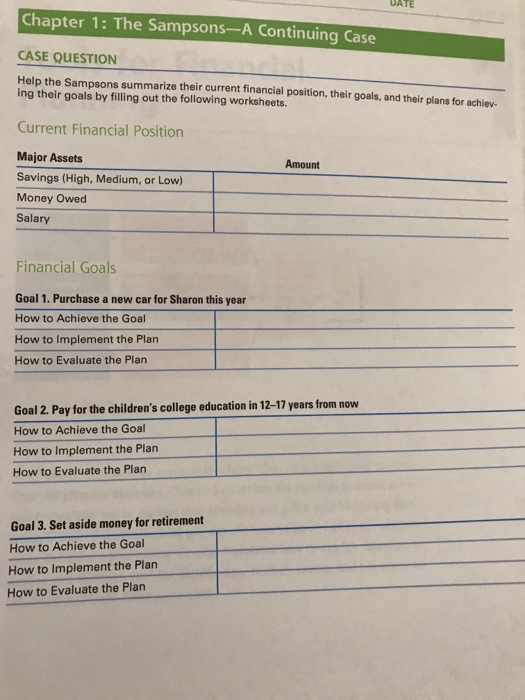

Current Financial Position

| Major Assets | Amounts |

|---|---|

| Savings | Low |

| Money Owed | $92,000 |

| Salary | $60,000 per year |

Goal 1: Purchase new car for Sharon this year

| How to achieve the Goal | Sharon plans to save money for the down payment |

| How to implement the Plan | Saving $ 500 per month to save at least $ 5,000 for the down pyment |

| How to Evaluate the plan | $ 500 per month will save $6000 by the end of the year. |

Goal 2: Pay for the children’scollege education 12 – 17 years from now

| How to achieve the plan | The savings done should be invested in child education policies to yield future benefit |

| How to implement the plan | Sharon’s salary will be saved $ 300 p.m. |

| How to evaluate the plan | The plan is successful if the amount is regularly saved and invested |

Goal 3 : Set aside money for retirement

| How to achieve the goal | Extra earnings will be required in order to achieve this plan |

| How to implement the goal | Sharon after few years can look for a full time job instead of part time |

| How to evaluate the goal | The financial advisor’s plan will help them to plan the savings and money expenditures |