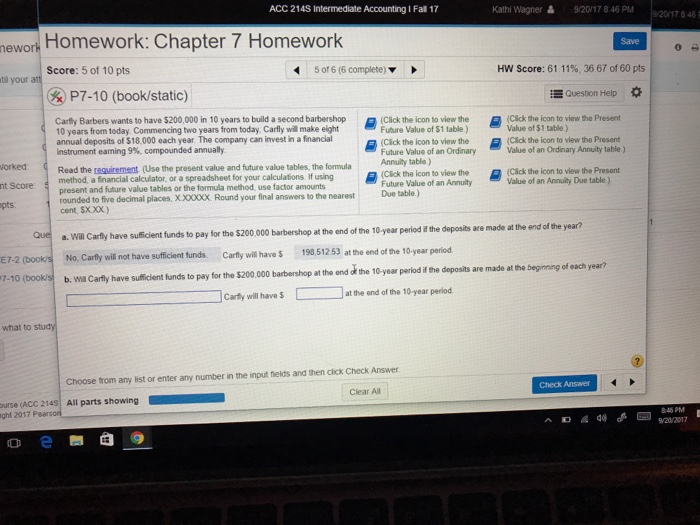

ACC 214S Intermediate Accounting I Fal 17 Kathi Wagner 9/20/1 7 8 46 PM 9/201748 hewort Homework: Chapter 7 Homework Save Score: 5 of 10 pts 506(6 complete)▼ HW Score: 61 11% 36 67 of 60 pts l your att P7-10 (book/static) Question Help * vie Carey Barbers wants to have S200000 in 10 yearst build asecond barbershop 10 years from today Commencing two years from today, Carfly will make eight annual deposits of $18,000 each year The company can invest in a financial instrument earning 9%, compounded annually ickthi the Present 물 (CSck teko n to view the Future Value of $1 table.) Click the icon to view the Future Value of an Ordinary Annuity table ) Value of $1 table ) (Cick the icon to viewtho Present Value of an Ordinary Annuity table ) Read the requirement (Use the present value and future value tables, the formula metod a financial calculator or a spreadsheet for your calculations fusi g present and future value tables or the formula method, use factor amounts rounded to five decimal places, X,X000X Round your final answers to the nearest cent, Sxxx) orked (Cäck the icon to view the Presont Value of an Annuity Due table.) Cick the icon! Future Value of an Annuity Due table.) pts. end of the year? a. Will Carfly have sufficient funds to pay for the $200.000 barbershop at the end of the 10-year period if the deposits are made at the Que No, Carfly will not have sufficient funds. Carfly will have $ 198,51253 at the end of the 10-year period E7-2 (book/s 7-10 (books b. wa Carily have suicient funds to pay for the $200.000 barbershop at the end of the 10-year period if the deposits are made at tho beginning of each year? at the end of the 10-year period Carly will have $ what to study Choose trom any list or enter any number in the input fields and then clck Check Answer Check Answer Clear All urse (ACC 214S All parts showing ght 2017 Pearsor /20/2017

Expert Answer

(b)

| Yes, Carfly will have sufficient funds | Carfly will have $ | 216378.66 | at the end of the 10-year period | |||||||

The calculation is shown below.

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

| Annual saving | 18000 | 18000 | 18000 | 18000 | 18000 | 18000 | 18000 | 18000 | |||

| Multiplier (@9% return) | 1.9926 | 1.8280 | 1.6771 | 1.5386 | 1.4116 | 1.2950 | 1.1881 | 1.0900 | |||

| Value of the investment | 35866 | 32905 | 30188 | 27695 | 25408 | 23311 | 21386 | 19620 | |||

| Total Value | 216378.66 |